Tax Credit Overpayment

Hylton-Potts - London Based Law Firm Helping People Across the UK since 1999

Table of Contents - Click to

Tax Credit Fixed Fee

Tax Credit Fraud : £1250

Tax Credit Civil Appeal: £1250

Learn more by clicking on the podcast on our Homepage.

Tax Credit Lawyer

The Government has tripled its resources into Benefit Fraud, Pension Credit and Tax Credit Fraud enquiries.

It is not when if they catch you but when.

Consult the experts. For more information or a free legal opinion telephone 020-7381-8111 or email [email protected]

If you are in trouble for having wrongfully claimed tax or pension credits, we can help.

We have an excellent track record in avoiding prosecutions – We can help you even if the prosecution process has started. We are here not to judge you but to help you.

We have great success in getting the HMRC, to look at cases again, and exchange a civil penalty, for a criminal prosecution, even if one has begun. We deal with the compliance team for you.

There are four reasons that the Tax or Pension Credit Office may charge a penalty or prosecute you:

- You have fraudulently given the wrong information on your tax credits claim – that is you deliberately gave the wrong information

- You have negligently given the wrong information on your tax credits claim – that is you didn’t take enough care to make sure the information given was correct

- You didn’t tell the Tax or Pension Credit Office about changes in your circumstances when you should do so

- You didn’t give the Tax or Pension Credit Office the information or evidence they ask for

Criminal investigations

In some cases you can face criminal prosecutions by the Tax or Pension Credit Office. Common sentences include:-

- imprisonment

- community service orders and/or

- confiscation of assets

Look at the Tax Credit Sentencing page for the tariff

As a minimum you will get a criminal record, with publicity.

We have a high success rate in negotiating and successfully defending these claims, or otherwise obtaining the best possible outcome, i.e. the re-payment of the tax credits claimed, with payment terms, without a criminal prosecution or even a caution.

Interview under caution

We never allow our clients to be interviewed.

We can help if you have been accused of subletting your property/flat.

We can help if you have been accused of unlawful, or fraudulent subletting.

We are experts in helping with Student Loans Fraud Prevention issues, and obtaining successful outcomes with DSA Counter Fraud Services.

We can prepare a statement with you in our office, to avoid an arrest and a stressful tape-recorded interview by the Fraud Enquiry Office and police.

As far as we know our approach is unique.

People break the law for all sorts of reasons. For some, the pressures of family life can push them into situations from which they find it hard to escape from.

At Hylton-Potts Legal Consultants we understand this and how sometimes people can get themselves into unfortunate situations. The work we do is more than just a job for us, and we work tirelessly to always get the best outcome for our client.

Tax Credit Lawyer

Hylton-Potts – We can help – We are on your side

At Hylton-Potts we can further reduce a sentence by making representations as to the circumstances of the offence and how the fraud began, what the money was spent on and particular special matters relevant such as family breakdown, illness or disability. If a client has committed a benefit fraud in order to feed their young family, then we can ensure this is taken into account in sentencing and given full consideration by the court.

Pressure from others such as bullying by partners, forced marriages, not understanding the regulations, poor English, medical problems and full cooperation, are all factors we can help you with, to get the best possible result.

The Fraud Investigators know us all over the country and love our approach. We make their life easy, and keep investigation costs down.

Unlike experienced Legal Aid solicitors, we do not ask for copy documents for the sake of it, or treat them like idiots, which they are certainly not.

Invariably the response is “Thank Heavens you are involved. How can we sort this out ?”.

Contact the expert – Rodney Hylton-Potts

Free Legal Helpline and e-mail advice service

Phone 020 7381 8111 or [email protected]

We help people in England, Wales and Scotland with benefit fraud and tax credit problems.

If you want expert confidential advice consult the experts. For more information or a free legal opinion telephone 020-7381-8111 or email [email protected].

DSS compliance office

We can help with enquiries from the DSS compliance office, and dod not allow our clients to be interviewed. We can also help if you have a problem over foster care.

Necessity of arrest

In Richardson v The Chief Constable of West Midlands Police, the claimant sought damages for false imprisonment. He claimed that his arrest was unlawful on the grounds that the arresting officer had or no reasonable, grounds for considering that it was ‘necessary’.

The claimant, a teacher, faced an allegation of assault by a pupil. He had agreed to attend police station A by appointment with his solicitor. The solicitor made representations to the effect that arrest was not necessary on the basis that the claimant was content to be interviewed on a voluntary basis.

Nevertheless, he was duly arrested and according to the custody record, the arresting officer was of the view that the arrest was necessary for the “prompt and effective investigation of the offence”. The custody sergeant noted on the record that the arrest was necessary on the basis that the claimant would have to be arrested, should he attempt to leave during the course of the voluntary interview.

The claimant was released on bail and, in due course, informed that the police had decided to take no further action. He then challenged the lawfulness of the arrest by means of judicial review.

It was held that the arrest was unlawful as the defendant had failed to establish that the ‘necessity’ requirement had been satisfied. There was no evidence as to whether, and if so why, the arresting officer considered it necessary to arrest the claimant. There was no evidence that an evaluation was made of the need to arrest, taking into account all relevant circumstances including his voluntary attendance at two police stations and the absence of any evidence to suggest he was likely to leave before the end of the interview.

The court found that the arresting officer’s belief that arrest was necessary would have been unreasonable.

Defence solicitors should take a copy of this decision with them when attending the police station if it is anticipated that representations as to the necessity to arrest may be appropriate.

A practice has developed at certain police stations of declaring an arrest to be necessary for a prompt and effective investigation, supporting this with a perfunctory reference to the seriousness of the matter or the hypothetical risk of the volunteer leaving mid-interview.

However, this case demonstrates that courts will expect contemporaneous evidence that the necessity test was given proper consideration by the arresting officer and that there was a proper evaluation of all the relevant circumstances.

It is now clear that an unsubstantiated assertion that the volunteer may choose to leave mid-interview, in the absence of any evidence in support of this contention, is unlikely to satisfy the necessity requirement.

Accordingly, it is crucial that advisers ensure that all relevant circumstances are brought to the attention of the arresting officer and that any representations are fully endorsed on the custody record.

If you have a problem with the police, or could be arrested, consult the experts – For more information or free legal advice telephone 020-7381-8111 or email [email protected]

We have a good knowledge of welfare benefits and the entitlement criteria that go with them.

We have extensive experience of tribunals and have attended appeal hearings personally. We are particularly familiar with what appeal chairs are looking for to reverse authority decisions.

Taxman casts an online net

New Credit checks will trap benefit fraudsters – click to read

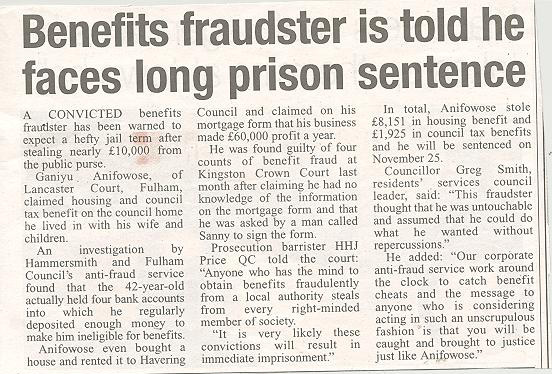

Jail for benefit cheat who bought a house – click to read

Benefits cheat with £1/2m in property – click to read

New Blitz on Benefit Cheats – click to read

Door-to-door blitz on benefit cheats – click to read